The focal point of your company.

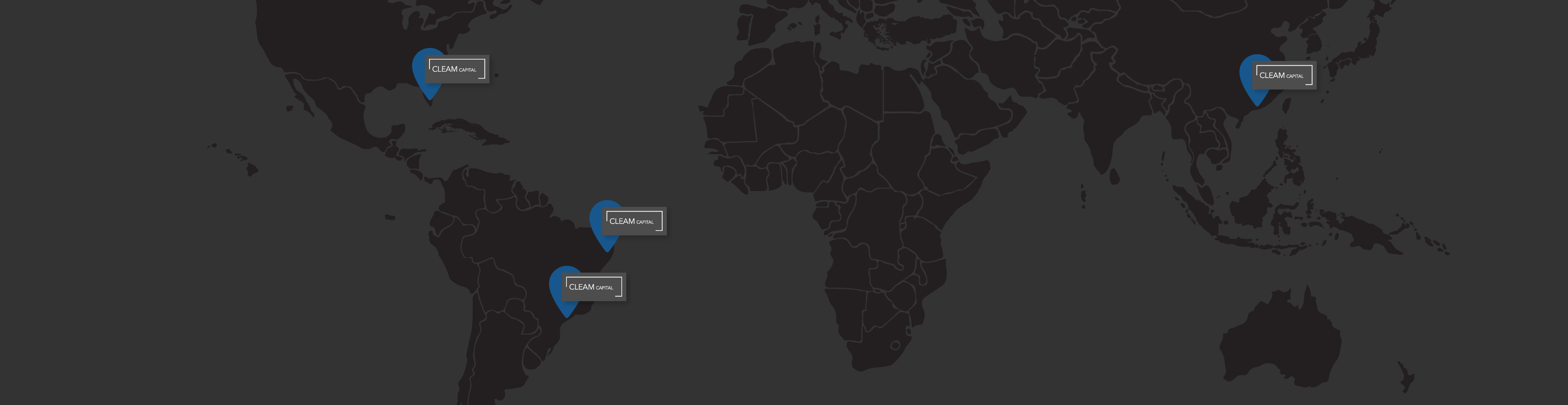

CLEAM CAPITAL is a distinguished family office committed to delivering tailored liquidity solutions for private equity funds and institutional investors. Our expertise lies in acquiring portfolio companies, carve-out business units, and other assets that no longer align with strategic imperatives, enabling optimal capital reallocation.